People often ask me – What are the stocks to buy for a long term of 5 or 10 years in the

Indian market to see a significant hike? And my answer is – chances are that people might

lose their money if you are looking for appreciation of your money by investing in few

stocks specially in India. Don’t just invest and forget.

Keep monitoring. You will be lucky if the company is still there after that many long years

to reap the benefit. It sounds scary – right? Corporates have become so greedy that

quite often they kick off shareholders benefits.

There is a strong reason that why people have shifted from long term investment to

trading. Foremost reason is that even some big companies in the country have broken

peoples trust after many years of business.

Frankly speaking, now a days scenario is such that even the best of the company in

Nifty or any other valuable company can just announce some fraud and stock price start

plummeting over night. It can any damn big company. Any name.

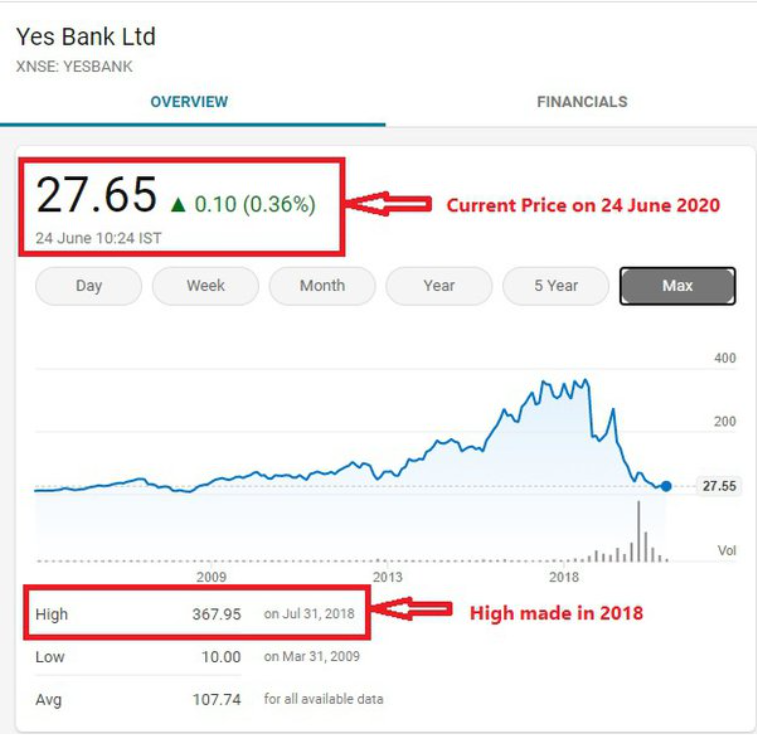

Look at the recent case of YES BANK. look at its graph:

This graph clearly shows the price is at the same level of when they started more than

15 years back. In 2005. It was listed at Rs.45 after its IPO in 2005. It is currently trading

below its issue price after 15 years. Long Term Investment result = Zero.

Interestingly, Yes Bank stock remained one of the traders and punters favourite. They

made hell lot of money after its debacle close to 2 years ago. Government also favored

big banks and they bought the Yes Bank’s stock at their own chosen price and not that

of the market.

Retail investors were forced to be put under moratorium for three years, while the banks

those who purchased that stock at a price of penny were allowed to sell off their 10%

and the with the help of speculators within a months time the price was fluctuated from

the low of near about Rs.10 to Rs.80 plus, and from there it fell to its current price. So

banks liquidated their 10% and covered the cost of investment. So you see how retails

investors were looted.

And this bank was run by no other than great Rana Kapoor for many years before he

was forcibly ousted and taken over by Ravneet Gill. This is Great Rana Kapoor below

and I am sure you must have seen his pics in many corporate magazines and business

news during his hey days.

To the surprise, he has been awarded banker of the year and many other corporate

awards. So be careful of what you see in the news.

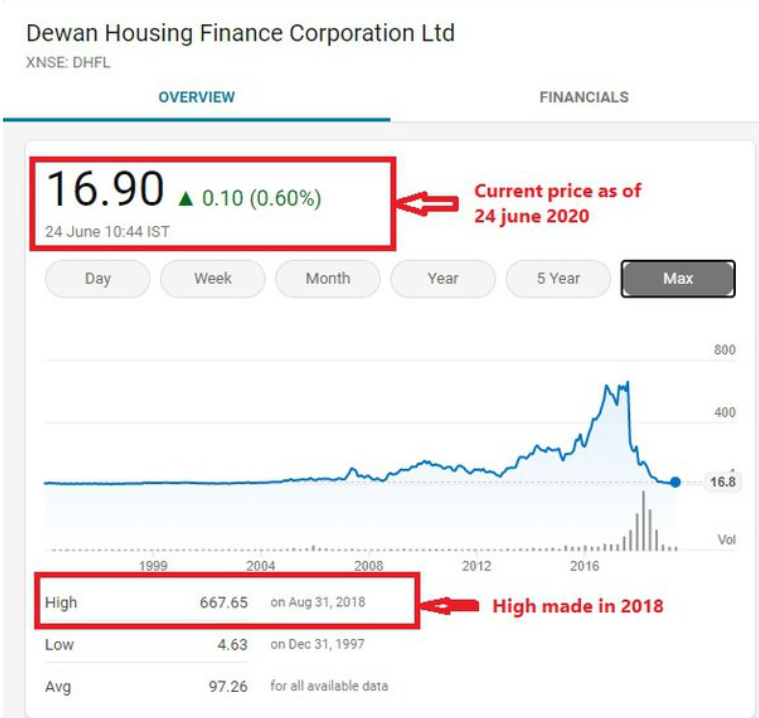

Second scenario: DHFL (Deewan Housing Finance Ltd):

Look at the graph and their story is as good as Yes Bank. DHFL was a household name.

Millions of people trust were broken those who invested in it. If you look carefully the fall

in the graph, it is so straight. This clearly indicates that the rotten was already planned

in advance, There is no limit to the corporate greed. While investors are facing the burnt,

promoters are enjoying a lavish life with no shame.

These Wadhawan Brothers who ran this DHFL are also behind the PMC bank fraud

case. Millions of depositors lost their valuable money but these promoters have no

scarcity in their rich life style.

Long Term Investment result = Zero.

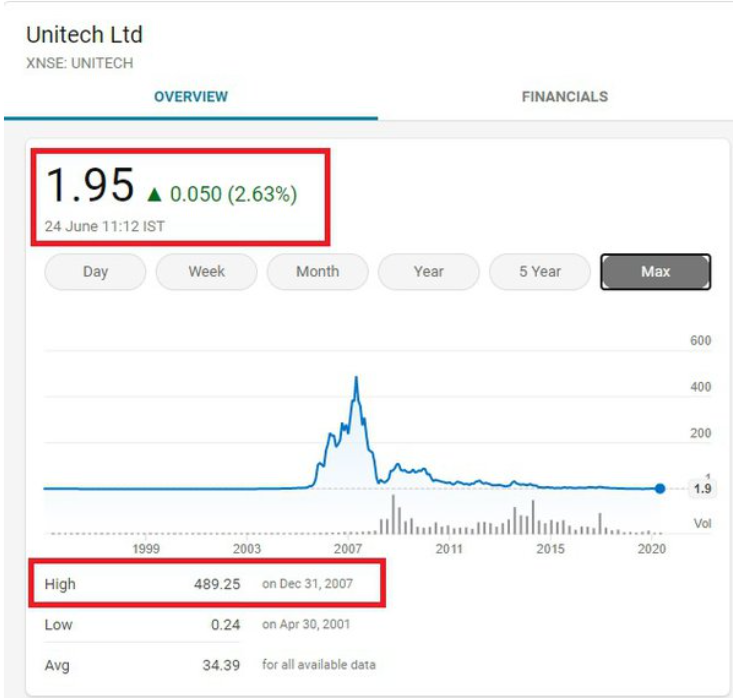

Another case is of Unitech:

It was a famous company in real estate during its hey day.

I think the Graph itself is self explanatory for its own story.

Long Term Investment result = Zero.

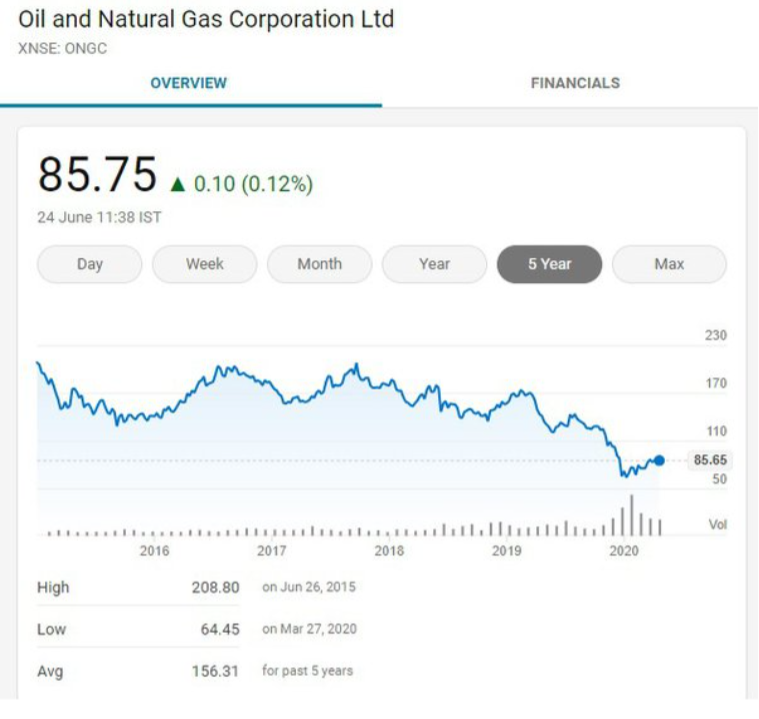

Now lets come to the famous PSU’s stock also. Everyone knows the name of ONGC, It

is one of the Maharatnas stocks. Our present govt is so greedy of money that they have

spoiled all the PSU’s stocks so that they can sell them sooner or later to Private hands.

So in the case of PSU’s the promoter is Govt. So if the Govt becomes lethargic towards

their units, whom can you rely on to save them. Look at the stock of ONGC in the last 5

year.

It is continuously falling in the last 5 years. No Respite.

Long Term Investment result = Negative.

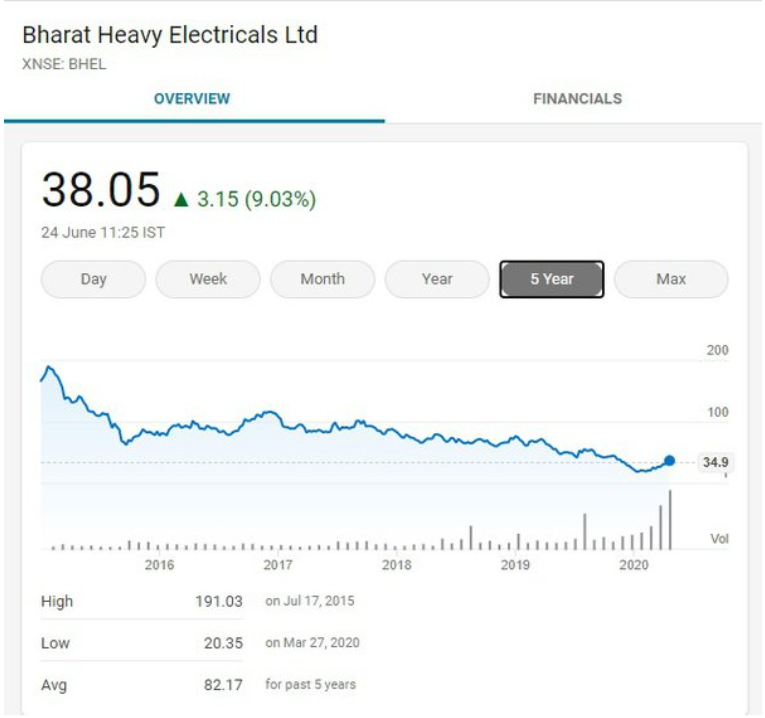

Now look at another famous PSU. This stock has been the major booster in energy

sector heavy machinery. Yes, it is none other than BHEL. It has helped many energy

sectors in India since its inception. Now look at what is happening to their stock.

BHEL is also continuously falling for the last 5 years. Long Term Investment result = Negative.

I understand that in India govt promoted companies or govt companies does not work as

good as private ones. However, ONGC and BHEL were exceptions. So, I have included

those. These were not small or loss-making ventures. But they will be made such sooner

or later so that it can be sold off.

However, the point for all these information is that when you are investing for long term,

be careful of what is happening to its stock and keep monitoring it regularly. One small

mistake can cost you a fortune.

Neither the govt, nor the private companies are thinking about people’s money. Both

have a great nexus and they take people hard work and their hard-earned money for

granted as if it is their own money.

Had this not been the case Wadhawan Brothers, Yes Bank culprits, PMC bank culprits,

would have been behind bars.

Do invest in share market as it has helped boosting my returns greatly than any other

form of investment – but not without learning.

Praise the Lord.